Navigating Personal Injury Protection for Car Accidents

Personal Injury Protection (PIP) is a crucial component of auto insurance designed to provide financial protection to individuals involved in automobile accidents.

PIP not only safeguards individuals but it also promotes timely recovery and reduces the burden on the healthcare system. Understanding the benefits and limitations of PIP is essential for anyone seeking comprehensive protection in the event of an accident.

Also known as ‘no-fault’ insurance, PIP goes beyond traditional liability coverage by covering medical expenses, lost wages, and other related costs.

This type of insurance is mandatory in some states and offers a safety net for policyholders to obtain immediate medical treatment.

Let us, in this article, have an overall review on Personal Injury Protection (PIP).

Understanding the Personal Injury Protection

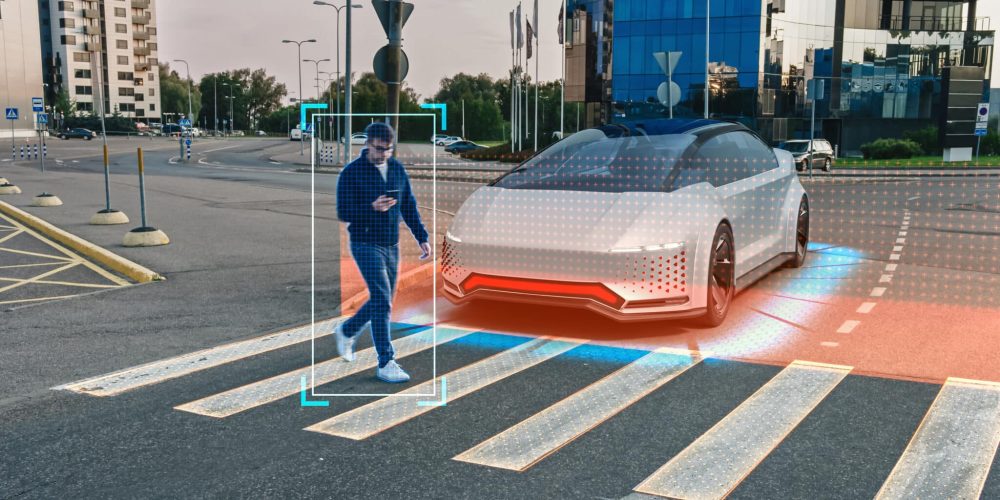

Looking at the rising concerns about the transportation landscape in many states of the U.S. this insurance was launched. Some states have a mandatory requirement of PIP coverage while others have an optional choice.

It is a part of an automobile insurance plan that covers expenses related to a car accident. In some states, non-medical benefits, including coverage for lost wages, household services, and disability are also covered.

It can protect you, your passengers, and your household members, even if they are not covered by your policy. It is a fast way to compensate for the loss without digging deeper into who is at fault for the time being. Once the medical facility is provided, you may then proceed toward legal necessities.

What About Other Factors?

It is important to keep in mind that PIP only covers the expenses of bodily injury. Other damages are not deemed to be compensated under the insurance. Now, for places like St. Louis, Texas, Georgia, where accidents happen often, it can only act as an additional benefit.

For instance, a car accident lawyer in St. Louis may suggest you go for the insurance for added safety. You will still have to fight legal battles for other damages which can be done best by a specialized attorney.

According to TorHoerman Law, you can opt for a free consultation with an expert legal team to understand the legal landscape. It helps you to ease the aftermath of an accident which can be pretty overwhelming. This is a great way to direct your legal battles if you have suffered an accident.

Difference b/w PIP and Liability Insurance

Some people might confuse personal injury protection as being the same as liability insurance. However, they are very distinct from each other. Let us have a look at the key differences that the aforementioned have:

Personal Injury Protection

- It is mandatory in 16 states of the United States

- It does not cover property damage

- It covers the medical expenses of anyone in the policyholder’s vehicle

Liability Insurance

- It is mandatory in every state of the U.S.

- It covers property damage of the third-party if the policy holder is at fault, it does not cover the policy holder’s damages.

- It also covers the medical expenses of third parties if the policyholder is at fault.

Frequently Asked Questions (FAQs)

What expenses does PIP insurance cover?

PIP insurance typically covers medical expenses, including hospital bills, doctor visits, surgery, and rehabilitation costs. It may also cover lost wages due to the inability to work, funeral expenses, and even child care expenses if the insured person is unable to care for their children due to injuries sustained in the accident.

Are there any limitations to PIP coverage?

PIP coverage typically has certain limitations, such as a maximum coverage limit. This means that the insurance will only pay up to a certain amount for medical expenses and other covered costs. Additionally, there may be restrictions on the types of treatments or providers covered by PIP insurance, so it’s important to review the policy details carefully.

Does PIP insurance cover passengers in my vehicle?

Yes, PIP insurance generally covers passengers in your vehicle, including family members and friends. However, coverage may vary depending on the insurance policy and state regulations, so it’s advisable to check with your insurance provider to understand the specific details of your policy.

Can I use my health insurance instead of PIP?

In some cases, your health insurance may cover medical expenses resulting from a car accident. However, PIP insurance is specifically designed to provide immediate coverage for accident-related expenses, without the need to determine fault. Using PIP insurance can help avoid delays in receiving medical treatment and potentially reduce out-of-pocket expenses.

Before going with any insurance policy, it is better to thoroughly understand all the components of it. One should consult an attorney because legalities are anyway included.

However, these are all additional precautions to opt for. One should be careful and responsible towards road safety as passengers, drivers, or pedestrians.

Michael Dorrance is a seasoned tech writer with extensive expertise in a wide range of technology topics. His insights and analyses provide readers with in-depth understanding and innovative perspectives in the tech world.